.jpg)

Donaldson, Lufkin & Jenrette Securities Corp., a New York Investment company, spearheaded the buyout, and was joined by Hicks & Haas, a Dallas merchant bank. The streamlined Sybron came under new ownership again in October of 1987. New management also took Sybron private again and, because of the elimination of many of its subsidiaries, quashed its Fortune 500 status. By late 1987 Sybron had become a smaller, leaner, more profitable company specializing in the manufacture of laboratory and dental products. Over a period of 18 months the new owners slashed corporate headquarters staff to just 24, jettisoned 12 entire operating divisions, and cut Sybron's debt load to just $65 million. In cooperation with Sybron management, Forstmann purchased the company and initiated an aggressive restructuring program. In 1986 Sybron was purchased, by way of a leveraged buyout (LBO), by LBO specialist Forstmann Little & Co. The headquarters staff had swollen to a beefy 240 and Sybron had committed itself to more than $315 million in long-term debt.

In fact, by the mid-1980s Sybron had become bloated and inefficient. Its financial performance, however, began to wane. The organization's sales and assets had rapidly ballooned and Sybron had become a Fortune 500 company. By the mid-1980s, in fact, Sybron encompassed a diversified group of nearly 20 companies, most of which were engaged in the manufacture of various dental, laboratory, and specialty industrial products. Marshall Hyman took over as president of the Nalge subsidiary in 1976.īesides Nalge, Sybron added a variety of businesses to its portfolio. By 1976, the year that founder Goldberg retired, Nalge boasted a work force of 250 and more than 240 products.

Throughout the 1970s and 1980s Sybron bought and sold numerous companies that complemented varying business strategies, but Nalge remained a core subsidiary. The new organization was named Sybron Corp., which was effectively a holding company for the diversified subsidiaries.

In 1968 Ritter-Pfaudler merged with a company called Taylor Instrument Co. In 1966 Goldberg agreed to sell his enterprise to Ritter-Pfaudler Corp., of Rochester, New York-Goldberg remained president of the company and operated it relatively autonomously until 1976. Because of its strength in its niche, Nalge became a takeover target for larger, more diversified companies. By the mid-1960s Nalge, which is credited with pioneering the use of plastic in laboratory and industrial applications, was producing 180 different products in nearly 700 sizes. From pipette jars, Nalge quickly expanded to produce a wide array of plastic items for industrial and laboratory use. Sales were brisk and Goldberg incorporated the venture in 1954. Emanuel Goldberg founded the company to produce one thing: polyethylene pipette jars used in laboratories. Sybron's roots can be traced back to the founding of the Nalge Co., in 1949, in Rochester, New York. In 1995 Sybron was operating through four subsidiaries: Nalge Co., Erie Scientific Company, Barnstead/Thermolyne Corporation, and Sybron Dental Specialties. The enterprise has acted as a holding company since its inception in 1968.

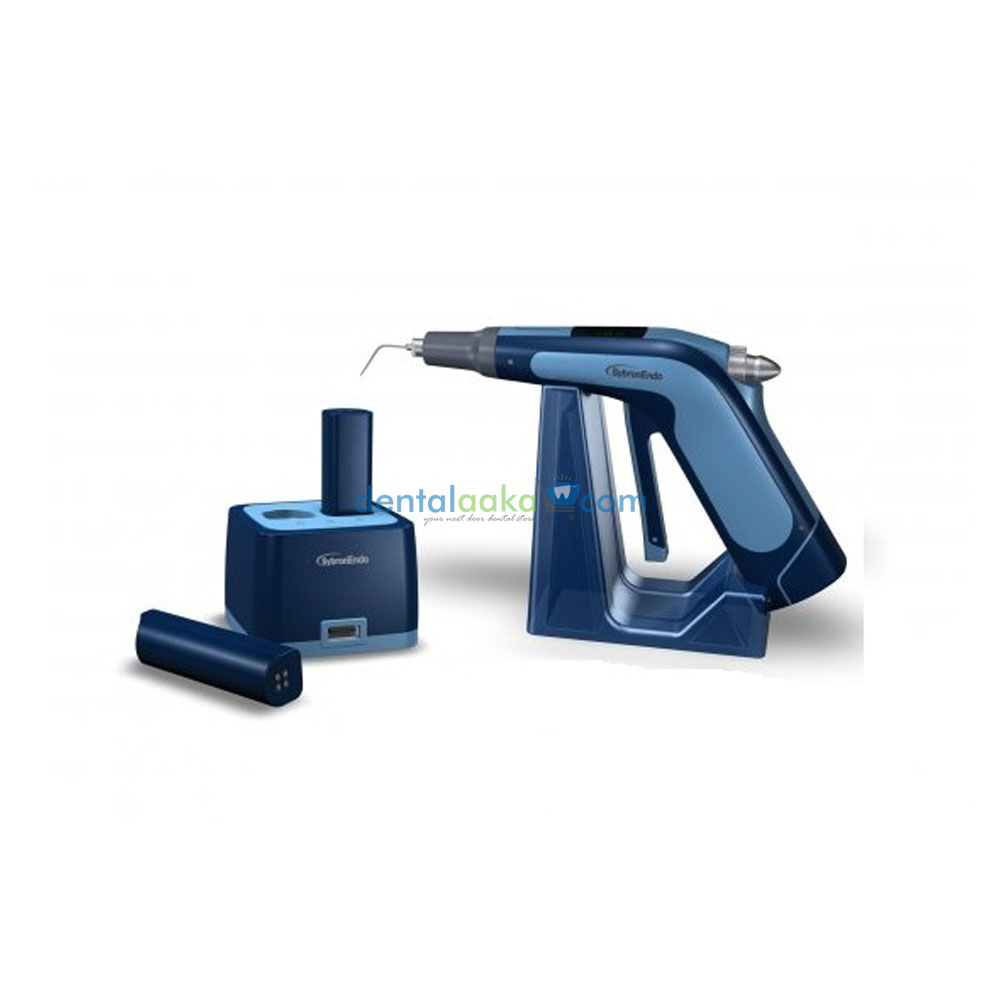

#Sybron endo professional#

is a leading manufacturer of products for the laboratory and professional orthodontic and dental markets in the United States and abroad. SICs: 3842 Dental Equipment & Supplies 6719 Holding Companies Not Elsewhere Classified

0 kommentar(er)

0 kommentar(er)